data & analytics

Gestion Maritime's

Investment Process

The Modern Approach to Shipping Risk and Investment Management

The board and management of Gestion Maritime Group were founding actors of what is increasingly referred to as the ‘Modern Approach’ to shipping investment and portfolio management. The Modern Approach utilizes current techniques in quantitative finance, risk and investment management in a systematic way in order to maximise shipping portfolio risk-adjusted returns.

Historically, the shipping industry has followed the ‘traditional’ approach to capital deployment. Such an approach seldom uses historic data or financial risk analysis, and relies heavily on gut instinct. The results of the traditional approach have been consistently poor over the medium to long term, particularly in the listed space.

data & analytics

Gestion Maritime’s

Modern Approach in Practice

01

Data Identification

Identify relevant data using market insight and statistical analysis

02

Data Capture

Capture data within a robust an automated process

03

Data Cleaning

Identify and isolate outliers

04

Analytics Selection

Identify suitable analytics for task at hand

05

Sector Selection

Using generic internal prices, identify sector with highest portfolio risk/ return contribution

06

Asset Selection

Select those vessels with the most desirable yield or capital appreciation characteristics

Portfolio Construction

Size exposures based on expect asset and portfolio target return

07

Scenario Analysis

Standard portfolio stressing and hedging instrument identification

08

Capital Structure Choice

Determine optimal amount of leverage given income/capital appreciation, and associated covenants

09

Execution

Target best execution

10

Risk Monitoring and Management

Regular review of risk (expected vs realised, hedge effectiveness and cost, target performance gap)

11

Rebalance accordingly

12

data & analytics

Robust Data Set

While efficient management of shipping risk and investment management processes begins with data, the data structure within the shipping industry is fragmented and disorganised.

In response, Gestion Maritime Group has accumulated and maintains a comprehensive database of historic vessel prices, transaction data going back two decades, earnings and numerous analytics for some 25 000 individual vessels – representing the majority of the liquid global fleet.

This dataset, currently comprised of some 1bn shipping data points, constitutes the feedstock for Gestion Maritime Group’s bespoke internal shipping risk and investments management system that is unique within the industry.

Gestion Maritime Group’s shipping risk and investment management system allows the team to adapt processes that are standard within the institutional / alternative investment sector to the nuances of the shipping markets.

This system has generated over 25% IRR since 2009 (audited) with no year-on year cash losses.

data & analytics

Pricing

Gestion Maritime Group’s unique approach to the systematic

pricing of the liquid global fleet uses a multifaceted approach.

01

Identify

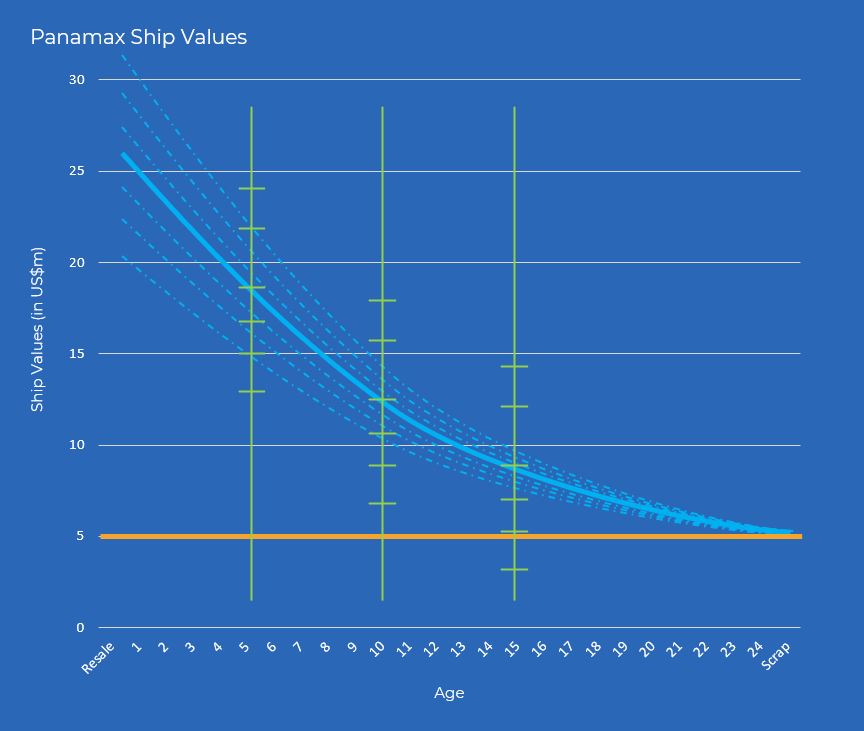

the shortcomings of the traditional approach, which assumes depreciation linearity

ship valuation

Traditional Approach

Ships have fixed economic lives and depreciate linearly

Fast, Simple & Easy to Calculate

However, in practice

Depreciation is not linear

Older vessels are more resilient in holding their value

Scrapping Age is not fixed

Conclusion:

Pricing approach should be flexible and adaptable to market practice

02

Adjust

for the lack of non-linearity observed in the market by combining market transaction data, broker inputs, and statistical analysis to build a reference generic curve

ship valuation

Gestion Maritime

Approach

Market Intelligence forms the fundamental building block

Relies on Broker Input to determine focal points on the pricing curve (e.g. 5Y price)

Generic Prices for the valuation of generic asset classes

Gaps in the Age Spectrum are filled-in using non-linear methods

Intuitive Prices consistent with market prices and market intelligence

03

Identify & Quantify

those vessel-specific offset that allow for the fitting of a unique curve for each vessel

ship valuation

Offsets

Offsets are determined by market intuition and confirmed via Statistical Analysis

Factors include:

Shipyard and Country of Built

Type of Engine

Physical characteristics of vessels

Ballast water treatment

Scrubber fitted

and many more…

The impact of each offset varies, depending on a range of factors, is reviewed periodically and is also supported by statistical analysis, where possible (See scrubber example below)

data & analytics

Analytics

Though commercial vessels share some common characteristics with other asset classes, this alternative asset class has many unique features that require specific expertise to identify and manage.

These include:

Vessel (Asset) heterogeneity

Data fragmentation

Informational asymmetry

data & analytics

Data Structure

& Setup

Gestion Maritime Group has built a robust data warehouse with a end back and front end. This functionality far exceeds that of the majority of shipping companies.

The internal front end is implemented in React as a front-end framework, Redux for the state management and AWS Amplify for AWS integration.

The application handles the user management using Amazon Cognito User Pools, which provide a secure user directory, supports multi-factor authentication and encryption of data-at-rest and in-transit and controls the access of backend resources in a secure way.

The Backend is deployed on AWS under a serverless architecture, with AWS Lambda functions used for data processing. Lambda functions are wired with AWS API Gateways for exposing secure, scalable and manageable REST APIs, the APIs are also wired with AWS Cognito for secure access.

The data storage sits on an Azure SQL Server, with multiple instances, hosting more than 900 million datapoints, secured and limited by a specific private network that allows only traffic from the backend components.

The continuous integration is managed by AWS Amplify. The deployment process is synched with the code that it situated on a private repository on Github for all the available environments.

The portal is deployed over AWS S3, with Cloudfront used for the global caching and performance boosting, with backend processing executed in containers by AWS Lambda.

Gestion Maritime SAM

Operations

7, Rue du Gabian,

Fontvieille,

Gildo Pastor Center,

5th Floor, Bloc A

98000 Monaco

© Gestion Maritime 2022 – All rights reserved | Privacy Policy | Terms & Conditions

© Gestion Maritime 2020 – All rights reserved